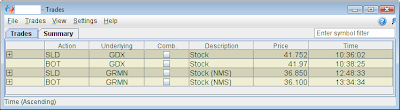

GDX, GRMN

Took a quick loss in a GDX B&B trade. Shorted on a break of the 10:30 bar low (3-min). A look back on that trade and the volume wasn't what I would like it to be leading up to my entry. I look for lower volume and as you can see... volume was kicking up.

I then turned my attention over to GRMN. I initially missed a good setup off the 3-min chart on a break of the 11:54 bar low (red arrow, line) which took out the morning pivot low that set up at 37.69. It had a bunch of room to fall down to the fib. ext. so I kept monitoring.

I entered on a break of the 12:45 bar low which took out the previous pivot low at 37.01. My price target was just above the fib. ext. which is where I ended up exiting all my shares. Even though price subsequently dropped further down, I made the right call to exit where I did because if I waited, I most likely would have exited at 36.49 or so... giving up considerable profit.

There were a ton of stock candidates in my watchlist today and I had a difficult time filtering through them all. So I ended up just focusing on stocks that had a very high relative volume number. That's probably a good approach to remember.

4 comments:

Nice trading.

You seem to be picking up the 3min charts and trading really well.

As per your comment, I had a lot of stocks to watch as well, and was finding it difficult enough to keep up on my 15min timeframe, never mind the 3min tf that you do :-) Still it probably becomes easier with experience.

thanks traderam. Trading off the 3-min charts is all about support, resistance and volume. I use trendline alerts a lot which helps me to set it and forget it (until I need to remember). Today I concentrated on high relative volume stocks as I'd hate to miss a setup just because I was 'organizing' my watchlist.

Congras on your new trading style!

When I take trades with tight stop like a few cents, a 3-cent slippage may double the risk. Do you find that to be a problem when trading the 3-min?

thanks tl. I do expect and allow for some slippage especially since I buy or sell .02 away from my entry signal. I typically allow for .06 (including the .02 criteria for entry) slippage on most trades. However, if it's a really tight entry I may bring that down to .04.

Post a Comment