Futures and hiatus

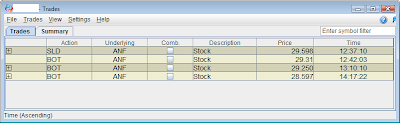

Been busy with futures and I'm convinced trading futures is where I want to go. Kinda like having a set watchlist but with only 3 stocks every day. The trick for me is to remain patient and pick the best time to enter. Hasn't been working for me for the last two days but I made some technical mistakes today that cost me from having a very good day. Mistakes as in buying when I meant to sell and not realizing it for 20 minutes.