Trade - 12/22/08

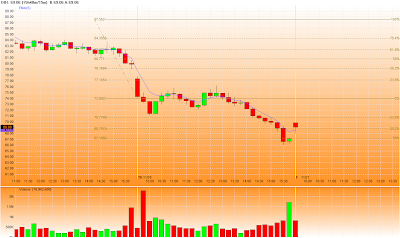

Didn't think I would (or want to) trade today but I had some time in the morning so I thought I'd fire up my scans and see what develops. PRU set up nice off the 5-min chart and I went short off a break of the 10:45 bar low after price kept finding the PDL as strong resistance. I didn't have the whole day to trade and actually needed to leave at 12:10 or so and that's when I dumped all my shares. Wish I knew how to place IB orders to sell 15 minutes or so before the end of the day. Got to read up on that.

A decent day with a nice entry and a good run. While I hate missing the runs... I do like seeing the stocks I enter do well.