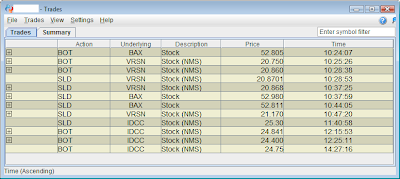

Tuesday's trades

Another solid day to build on the momentum from yesterday. In other words... I held serve :)

IDCC

Shorted off a break of the 11:30 bar low (10-min) off of a quasi-FU type trade. Scaled out a bit at 1R and the bulk after .90. I got ancy at the end of the day as price chopped around and sold all my shares before the big move down. Sucks to miss it but I won't complain.

VRSN

Long off a break of the 10:20 bar high (5-min) on a 'hangin' out' setup. Like the NR hammer on my entry bar and exited all my shares just above the fib. ext.

BAX

Went long off a break of the 10:10 bar high (10-min) after a 'brick wall' setup at the 25% fib. level (and 5ema). Thought this would do better but there was stiff resistance at the 54 level and I emptied most of my shares there and the rest at BE.

8 comments:

Happy to see good results, yesterday was a good day to be aggressive on the short side.

jf: yes, a lot of nice moves yesterday. Hope you did well.

I enjoy your trading these days OONR7. Keep it up!

gj bro!

I'm still in my bunker undeground, trying a few different things here and there but nothing much to write about.

Regarding BAX - at first I've tried to short off the 4th bar on your chart, but it hit a brick wall and I scalped it long. Then it came back and I shorted it off the same number (52.48) for a solid gainer to the high of the previous day.

thanks anarco... I hope to continue spotting good entries and managing trades better.

fir: I was stoked to follow your challenge and then... bam, nada :)

I know the times are tough but you should try it again - it's good discipline. Curious to hear your reasoning for shorting BAX the second time... did well.

After the 10min 4th candle it looked to me like one of X's new patterns... So I set the order a few pennies lower and it didn't trigger.

From my experience, many times, when a trigger doesn't work 1st time, it works much better on the 2nd attempt, so together with mkt's weakness I decided to go for it.

OONR7 - regarding the IDCC trade, what made not take it after the weak close of the 6th candle? Are you always looking for a green candle b4 that will be negated by a red one?

Thx

jj: yes, the 6th just didn't qualify for any of my setups. Most of my short trades do occur when the prior bar to entry is green and the entry is red. I called it a quasi-FU because the prior bar to entry found brief support at the ORL before the entry bar smashed through there.

Post a Comment